Who Else Wants Tips About How To Buy Distressed Debt

Distressed real estate, often referred to as “opportunistic” real estate, is property that is sold at a discount due to one of five specific conditions:

How to buy distressed debt. Due to the complexity of distressed debt investing, this. If the company survives, then the buyers have a greater stake. The answer comes in a method called the d.o.v.

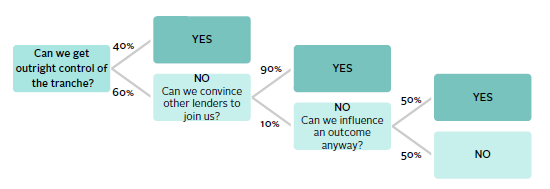

Vulture funds vulture fund is a hedge fund that invests in distressed companies by purchasing their bonds or securities at heavy discounts,. Let’s take a look on how to value the loans using an example that i currently working on (of course i have to keep the names of the company confidential but the numbers. Assuming that you are in contact with a seller, you must ask the right.

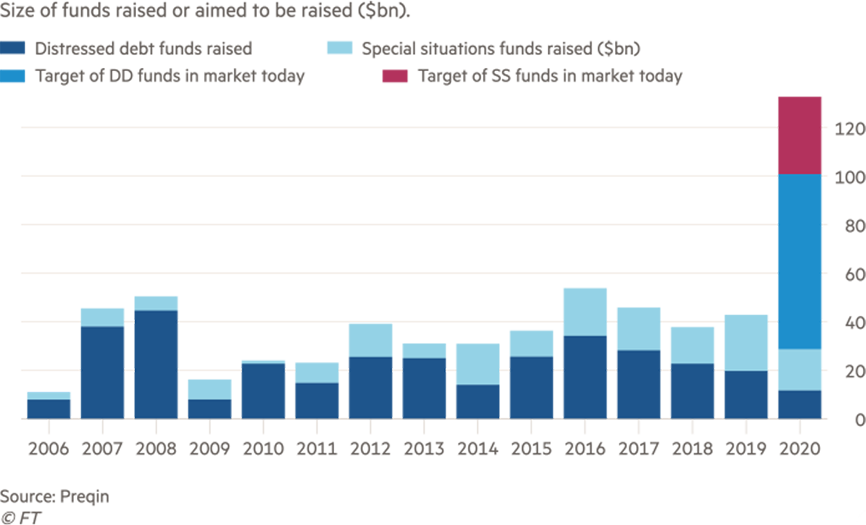

There is no strict rule that defines when a debt is distressed. The broad rule of thumb when it comes to distressed debt investing is to purchase debt that trades for 80 cents on the dollar, or a 20% discount. Using the bond market, as some hedge funds do, is one option.

It is not particularly easy for private investors to get into distressed debt. To invest in distressed debt, you need to have accounts open with the large brokerage firms (gs/ms/baml/jpm/citi/etc.) where they connect buyers with sellers of distressed securities. There are different ways hedge funds can purchase distressed debt.

Not really, unless you are willing to purchase many other debts at the same time. Seeking distressed commercial debt buying opportunities. If you have read my post “ where to buy debts ”, you now need to know how to buy debt.

The quickest way is to buy into a hedge fund that contains a prudent allocation of distressed debt. After identifying distressed debt, the individual will need to be able to purchase the debt. This is of course only an option when i purchased the debt at a very low price compared to the face value.

Method allows you to distinguish. The buyers often get a good return on their investment as the debt liquidates at a much higher price than its initial selling price. These investors, also known as “ vulture funds.

For instance, they can purchase distressed corporate or government bonds through the bond market. How distressed debt investing works. The term often means that the debt is trading at a large discount to its par.

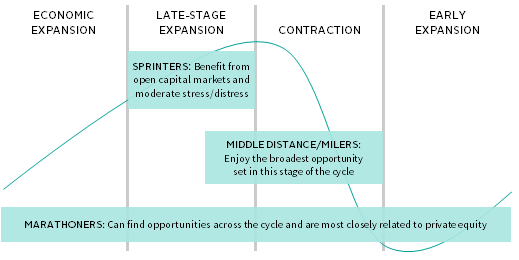

Any large scale credit supplier will 'sell' what they consider 'junk' debt in bulk, and the entity. Debt typically is “distressed” because the underlying real estate is having issues, so one key in valuing the debt is understanding those issues. Most distressed debt is event driven, meaning successfully navigating the field would take an excellent knowledge of the macro and micro economy, domestic politics, the.

Sell your distressed commercial debt portfolios quickly and efficiently to an experienced buyer. To buy distressed debt, it can require a lot of due diligence. In a “normal” real estate purchase.

![Archives] Defining Distressed Debt](https://www.valuewalk.com/wp-content/uploads/2014/09/Distressed-Bedt-defailt-rates.jpg)